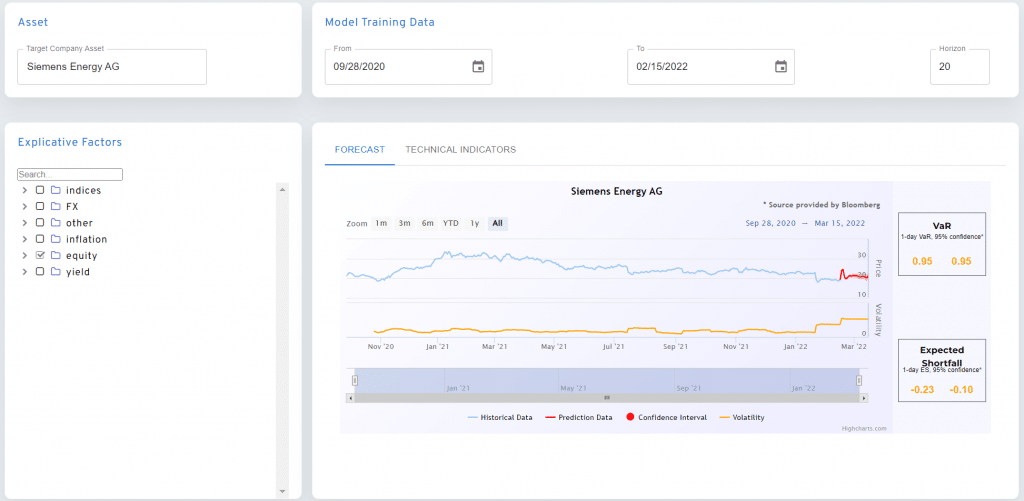

Produce predictions from your data with AI

The power of quant's tools at your fingertips

Anticipate market trends

Reduce risk

Maximize alpha

React to market in real time

Leverage key drivers, build resilient portfolio allocations

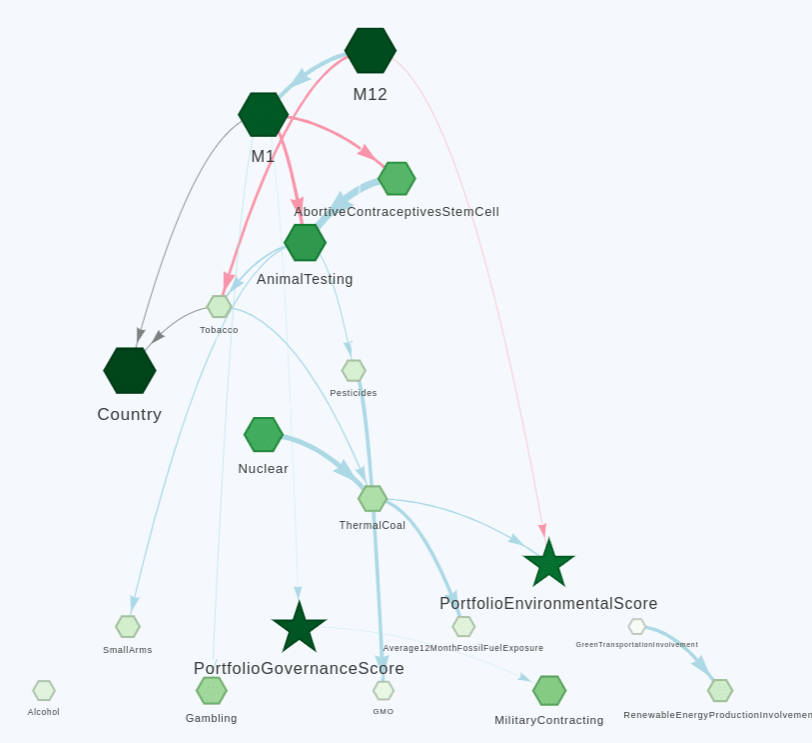

Control your model Explainable AI

White box model : Control and explain results

Short/long term

Forecast, nowcast

Unrivaled precision

FX, FI, equities, index, ETF, futures, options extra indicators, ESG factors, controverses

Causal AI empowering asset managers

Classic AI works on a statistical principle and the correlation between factors, considering that what happened will happen again exactly the same. It provides general probabilities on populations of events. Conversely, causal AI identifies the causal links between factors and builds models that can answer specific questions in the context of very specific factors or indicators. It makes it possible to estimate probabilities, to quantify confidence levels. Above all, it allows, on the basis of Bayesian logic, to verify and quantify intuitions and to compare them in their correct dimensions. It thus makes it possible to play scenarios by changing hypotheses, for the past (counterfactuals) or for the future (predictive).